Good Monday morning and welcome back. Although the ECB and FOMC Meetings are over and rates have been increased in the U.S., the Fed remains a focal in the markets due to the fact that we have a full calendar of Fed-speak on tap for this week. For example, at 8:00 a.m this morning, Federal Reserve Bank of New York President, William Dudley will speak, with Chicago Fed President Charles Evans scheduled to speak at 7:00 p.m. Then tomorrow, Vice Chairman Stanley Fischer, Boston Fed chief Eric Rosengren, and Dallas Fed President Robert Kaplan will all speak. And Governor Jerome Powell and St. Louis Fed President James Bullard are on the calendar later in the week. The questions that investors want more information on include (a) what the "unwind" plans for the Fed's balance sheet will look like and (b) if any FOMC members favor additional rate hikes in 2017.

Since it's the start of a new week, let's get right to our objective review the key market models and indicators. To review, the primary goal of this weekly exercise is to remove any subjective notions and ensure that we stay in line with what "is" happening in the markets. So, let's get started...

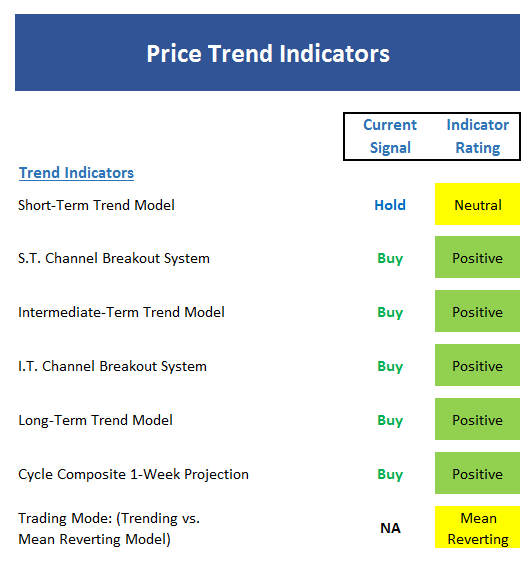

The State of the Trend

We start each week with a look at the "state of the trend." These indicators are designed to give us a feel for the overall health of the current short- and intermediate-term trend models.

View Trend Indicator Board Online

Executive Summary:

- The short-term Trend Model is now neutral as price is hovering right at the current short-term smoothing, which itself is moving sideways.

- The short-term Channel Breakout System remains positive but a break below 2415 would cause the indicators to issue a sell signal

- The intermediate-term Trend Model remains solidly positive ...