Modern times demand modern thinking in portfolio design. Learn more...

I've been exposed to a fair number of big name, experienced, highly qualified macro thinkers in the past couple of weeks. What I find interesting is that the theme from nearly everyone is consistent. Cutting to the chase, the idea is that the upside to the stock market is clearly limited at this time and that investors should accept the fact that returns are going to continue to disappoint - perhaps for years to come.

Frankly, it is hard to argue with the concept being presented as the list of reasons why stocks should stagnate is as long as your arm. And given that traders appear to have embraced the "Sell in May" season, just about everything I hear suggests that stocks have nowhere to go but down.

While I have penned a missive or two opining that there are some reasons to be optimistic about the future, even a card carrying member of the glass-is-half-full club like myself struggles to see "how" stocks are going to find a way to break on through to the other side.

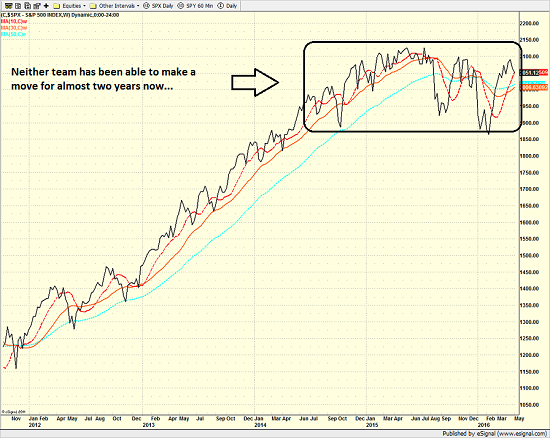

I mean, take a look at the chart below. Although I can and have argued that the action since mid-2014 represents a classic consolidation phase and that stocks should eventually resume their march higher, it is tough to come up with a reason why the bulls should embark on another big run from here.

S&P 500 - Weekly

View Larger Image

After all, we can't really expect another round of QE from the U.S., the ECB, or the BOJ, can we? Then again, I guess the PBOC could surprise everyone by starting a QE program of their own or decide to launch some sort of serious stimulus effort. But after umpteen moves by the Fed and the introduction of more acronyms than I can count across the pond, should we really expect global central bank intervention to push stocks higher?

Then there is what the folks dressed in fur call the "earnings recession." Don't look now fans, but EPS on the S&P 500, as well as the level of profits disclosed by the U.S. government, has been declining for some time now. If memory serves, the lifeblood of bull markets has been going the wrong way for 5 quarters now. And while it is easy to blame this problem on the oil bust and the dollar, there is no denying that earnings and profits are not improving.

Another "issue" being touted by the bear camp is the idea that stock buybacks have peaked. For what seems like an eternity now, companies have been able to manufacture better earnings by buying their own stock back on the open market. Heck, a great many firms even borrow money at today's cheap rates to implement the plan. (And this is where the term "unintended consequences" should leap to mind!) However, with profits declining, the thinking is that the amount of stock being retired by corporations will soon follow suit.

Next up is the subject of valuations in the stock market. Sure, I can argue that valuations are something that should be left to the eyes of the beholder and that relative to interest rates, the market is still cheap. In fact, I saw a report from Deutsche Bank today which suggested that P/E ratios are currently at no worse than average levels. (The punchline here is the chart used began in 1990.) Yet, there is no denying that when looking at the full history of the stock market, the traditional valuation metrics are currently on the high side. As such, unless (a) earnings improve or (b) the bulls can come up with a reason to embrace "multiple expansion," there isn't much of an argument for higher prices from a valuation perspective.

Then there is the issue of global growth - or lack thereof. Yes, I get it, global growth stinks right now. 'Nuf said, right?

Next up is the uncertainty of the election here at home. It seems the country will soon have a choice between another Clinton, a 100-year old socialist looking to give away all kinds of stuff, and a reality TV star with perhaps the worst comb-over in the history of man. Thus, investors couldn't be blamed for curbing their enthusiasm until they can figure out if these candidates are going to wreck the country. (P.S. The history of election years shows that stocks tend to struggle until the outcome of the election becomes apparent.)

And finally (I could probably go on, but I've got a meeting coming up in a few minutes so I'd best wrap this up in a tidy bow pretty quickly), I'm told that the combination of low cash levels at mutual funds and the high degree of margin debt in the markets represents another limiting factor one should to take into account before getting excited about buying stocks.

So, based on the issues addressed in this morning's meandering market missive (and probably some more that I left out) everyone seems to agree that the upside in stocks appears to be limited.

But (you knew that was coming, right?)... I really hate it when everybody on the planet is singing the same song. Experience has taught me that by the time everyone in the game agrees on what should happen next, something changes and "the crowd" winds up being wrong.

While I don't have any idea what might occur to put a spring back in the bull's step, it is worth noting that (a) the stock market is a discounting mechanism of future expectations and (b) after 18 months of sideways action, it is possible that the current theme that "everyone" can rattle off is baked in.

Let me close by asking you this. Are you optimistic about the future of the economy? Do you feel good about your job? Are you hopeful regarding the prospects for your business or the company you work for? Do you think you'll be making more money next year than you are right now? If the answer to any or all of the above questions is yes, then there just might be the possibility that the crowd has it wrong - again. Stay tuned.

Current Market Drivers

We strive to identify the driving forces behind the market action on a daily basis. The thinking is that if we can both identify and understand why stocks are doing what they are doing on a short-term basis; we are not likely to be surprised/blind-sided by a big move. Listed below are what we believe to be the driving forces of the current market (Listed in order of importance).

1. The State of Global Central Bank Policy

2. The State of Global Growth

3. The State of the Stock Market Valuations

4. The State of the Oil Crisis

Today's Pre-Game Indicators

Here are the Pre-Market indicators we review each morning before the opening bell...

Major Foreign Markets:

Japan: Closed

Hong Kong: -0.34%

Shanghai: +0.22%

London: +0.07%

Germany: +0.11%

France: -0.02%

Italy: +0.65%

Spain: +0.96%

Crude Oil Futures: +$1.37 to $45.15

Gold: +7.80 at $1282.20

Dollar: lower against the yen and pound, higher vs. euro

US 10-Year Bond Yield: Currently trading at 1.803%

German 10-Year Bund Yield: Currently trading at 0.202%

Stock Indices in U.S. (relative to fair value):

S&P 500: +8.80

Dow Jones Industrial Average: +65

NASDAQ Composite: +20.25

Thought For The Day:

"My reading of history convinces me that most bad government results from too much government." -Thomas Jefferson

Here's wishing you green screens and all the best for a great day,

David D. Moenning

Founder: Heritage Capital Research

Chief Investment Officer: Sowell Management Services

Looking for More on the State of the Markets?

!function(d,s,id){var js,fjs=d.getElementsByTagName(s)[0],p=/^http:/.test(d.location)?'http':'https';if(!d.getElementById(id)){js=d.createElement(s);js.id=id;js.src=p+'://platform.twitter.com/widgets.js';fjs.parentNode.insertBefore(js,fjs);}}(document, 'script', 'twitter-wjs');Disclosures

The opinions and forecasts expressed herein are those of Mr. David Moenning and may not actually come to pass. Mr. Moenning's opinions and viewpoints regarding the future of the markets should not be construed as recommendations. The analysis and information in this report is for informational purposes only. No part of the material presented in this report is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed constitutes a solicitation to purchase or sell securities or any investment program.

Any investment decisions must in all cases be made by the reader or by his or her investment adviser. Do NOT ever purchase any security without doing sufficient research. There is no guarantee that the investment objectives outlined will actually come to pass. All opinions expressed herein are subject to change without notice. Neither the editor, employees, nor any of their affiliates shall have any liability for any loss sustained by anyone who has relied on the information provided.

The analysis provided is based on both technical and fundamental research and is provided "as is" without warranty of any kind, either expressed or implied. Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

David D. Moenning is an investment adviser representative of Sowell Management Services, a registered investment advisor. For a complete description of investment risks, fees and services, review the firm brochure (ADV Part 2) which is available by contacting Sowell. Sowell is not registered as a broker-dealer.

Employees and affiliates of Sowell may at times have positions in the securities referred to and may make purchases or sales of these securities while publications are in circulation. Positions may change at any time.

Investments in equities carry an inherent element of risk including the potential for significant loss of principal. Past performance is not an indication of future results.

Advisory services are offered through Sowell Management Services.

Recent free content from FrontRange Trading Co.

-

Is The Bull Argument Too Easy These Days?

— 8/31/20

Is The Bull Argument Too Easy These Days?

— 8/31/20

-

What Do The Cycles Say About 2020?

— 1/21/20

What Do The Cycles Say About 2020?

— 1/21/20

-

Modeling 2020 Expectations (Just For Fun)

— 1/13/20

Modeling 2020 Expectations (Just For Fun)

— 1/13/20

-

Tips From Real-World Wendy Rhoades

— 5/06/19

Tips From Real-World Wendy Rhoades

— 5/06/19

-

The Best Recession Ever!

— 4/29/19

The Best Recession Ever!

— 4/29/19

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member